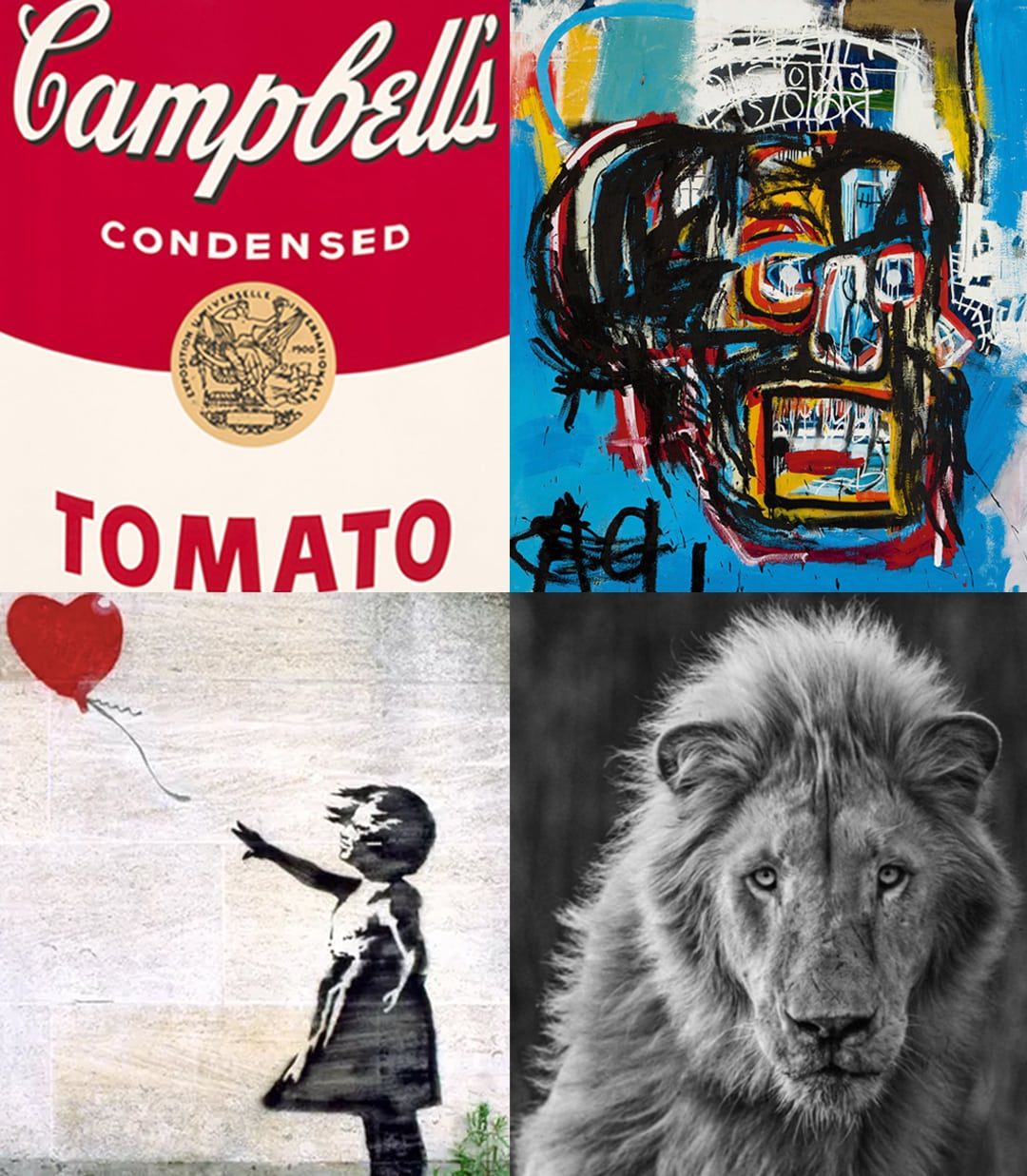

• ARTLIFE NEWS • ART & CULTURE

Your Guide To Collection and Investing In Art

Collecting and investing in art

Ready to Start Your Collection?

Success in this market hinges on insight and access. ArtLife delivers both. We source investment-grade prints and blue-chip canvases that build real portfolio value. Contact ArtLife today to access our private inventory and acquire your next asset.