Why Art Is An Attractive Alternative Asset In Uncertain Times

Though no one knows how long the Coronavirus pandemic will go on, it has managed to rattle investors in the short-term. The longest bull market in US history came to a screeching halt as the deadly virus spread across the globe in late February. With markets and financial institutions teetering on the edge of a recession (or worse), it’s no mystery why many investors are looking for alternative assets, including art, to counter the volatility.

Even in times of economic prosperity, critics have generally derided art as a risky and unpredictable investment. This criticism is not without some merit, either. A rough evaluation of the art market at large suggests that, for the average art fan (with an average income to match), large payouts from art investment are difficult to attain. In fact, the value of so-called “low-level” pieces seems to be in decline, even as art buyers continue to break records at more exclusive auctions.

Despite the naysayers who point to the exorbitant cost of “high-value” pieces, art investment isn’t going anywhere. Many analysts agree that Art is an attractive alternative asset, especially when global markets cannot offer any certainty to investors.

Art As An Asset Class

In order to evaluate art as an asset class, we must first determine how art differentiates from traditional investments. Historically, stocks, bonds, and real estate have dominated the investor’s landscape. However, art is unique insofar as it has virtually no connection to changes in these classes.

According to Raya Mamarbachi, author of Art As an Alternative Investment Asset, “indices tracking the performance of fine art have held up well in the recent economic slowdown with auction houses continuously reporting record prices.” This was also reflected in the Art Basel and UBS Global Art 2019 Market Report, which recorded over $67 billion in annual art sales — a 6% increase over the previous year. So, how is art flourishing while traditional asset classes flounder? The answer: high demand.

The Benefits Of Investing In Art

Art is an attractive alternative asset for a number of reasons. First and foremost, there are will always be a high demand for art. Very few living artists command exorbitant prices at auctions, which means that a lot of the art sold at auction are existing pieces. As long as the supply remains limited, demand for existing art and the small number of new pieces from famous contemporary artists will continue to grow.

The high demand and low supply of art also explain the sale prices which, at times, can get astronomically high. However, just because the highest bids make headlines doesn’t mean that they represent the experiences of every art investor. In fact, there were over 40 million art transactions in 2018 alone, with a mean average of under $5,000 per painting. Needless to say, you didn’t read about most of those sales in the newspaper.

Crunching The Numbers

There must be a reason why so many investors pour their money into art, even when prices are so unpredictable. Let’s take a closer look at two famous pieces to see how investing in art compares to more traditional avenues:

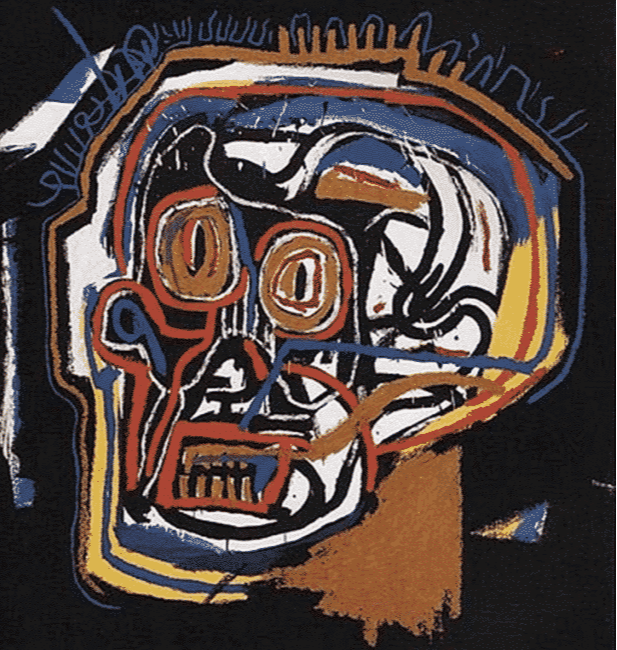

In 1984, artist Jean-Michel Basquiat’s painting, Untitled (1982), sold for $20,900 USD ($49,315 USD in 2017). Fast forward 33 years and this same painting sold at auction for $110.5 million USD. Accounting for inflation, the painting increased in value by about 224,060% between 1984 and 2017.

Similarly, Rudolph Stingel’s The Architect’s Home in the Ravine sold at a 2002 auction for $474,838 USD ($662,877 USD in 2018). Collectors and art investors bought and sold Stingel’s painting multiple times since then, culminating in its 2018 sale for $19,958,612 USD. Over a 16 year span, the value of The Architect’s Home in the Ravine grew by about 3,010%.

Meanwhile, if you were to invest similar amounts in the S&P 500 or real estate over the same period, the results would not be quite as impressive. Between 1984 and 2017, $20,900 in the S&P 500 (accounting for inflation and reinvested dividends) would turn into about $628,790, with a total growth of about 1,275%. Alternatively, if you invested $474,838 in the S&P 500 in 2002, you’d have around $617,290 (growth of 130%).

Real estate investors have it even worse. US real estate has an average return on investment that falls between just 10 and 15%. As you can see, both of these pieces outpaced more traditional investments by a long shot.

While these two pieces are outliers, they also show the nearly limitless potential of investing in art. Naturally, not all art requires multi-million dollar down payments. However, the “high-value” pieces still give investors the greatest opportunity to earn a huge profit.

Art Investment Vs. Risk

It’s easy to feel excited about investing in art when looking at the growth potential of a Basquiat or Stingel, but what about lesser-known artists? What about artists who are not sought-after in the moment, but have a good chance of exploding in 10 or 20 years time?

These questions expose one of the greatest criticisms of art investment: risk. After all, buying a piece of art is like buying stock in one company. You risk losing some or all of your investment if the company goes under, while you risk doing the same if demand suddenly drops off for the piece that you’ve acquired. Even worse, a stock can provide you with dividends, while a piece of art can only turn a profit through capital gains, meaning that you can’t even profit (or get some of your investment back) until the art is sold. To make things even more confusing, the value of a company’s stock is relatively easy to track and even predict, while the value of art can depend on the whims of critics, collectors, and galleries.

However, contrary to popular belief, art is not all that risky. It is unpredictable, but that doesn’t mean that it will ruin your life savings. The fact is that art trends, demand, and valuation are difficult (even impossible) to predict. This means that the $10 million art you bought yesterday may not bring you great returns when you’re ready to sell.

That said, art is surprisingly resilient through economic downturns. Some price volatility will occur (especially among lesser-known art), but the art market is generally able to self-regulate and maintain high demand, regardless of the lows and highs of the larger global economy. Much like mutual funds, art collectors and investors tend to see the largest returns when they wait. Since art is not a liquid asset, you’ll need to be prepared to wait at least 10-15 years before your investment pays off. In any case, even if the art world trends away from your $10 million painting, just wait. Your day will come.

Proceed With Caution

As with any investment, you will need to do a lot of research beforehand. Plenty of investors have been swayed by misleading auction data or marketing hype, so you should always verify the information before making any kind of purchase. Finally, when valuing art as an alternative asset, always remember to strike a balance between your non-traditional assets and the rest of your portfolio. Even though art is an attractive alternative asset, it shouldn’t be your only asset.

If you’d like to learn more about making art an alternative asset for your portfolio, you can always contact us. (shameless plug!).