• ARTLIFE NEWS • ART & CULTURE

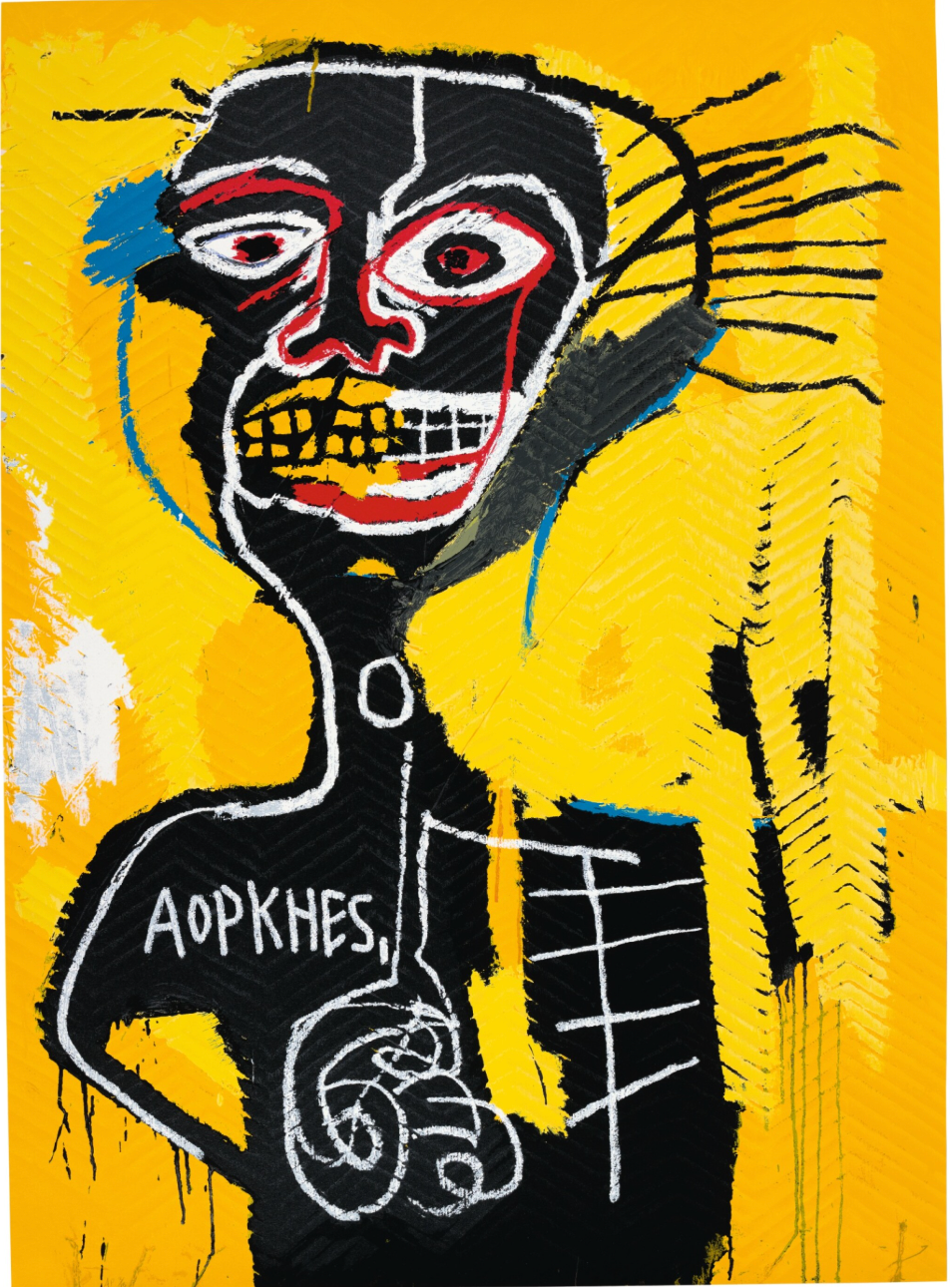

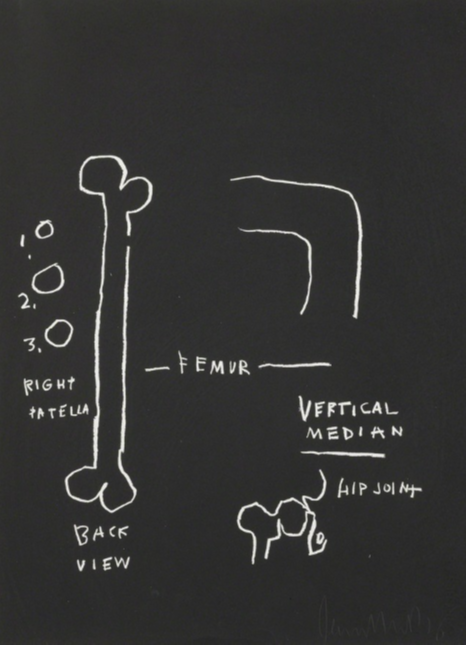

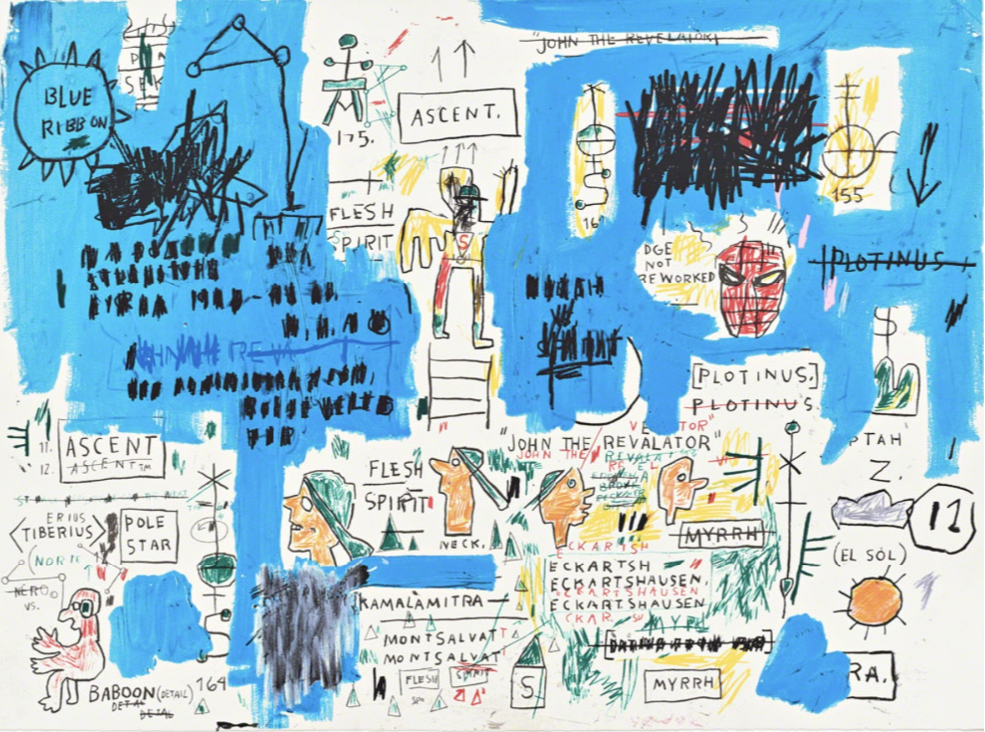

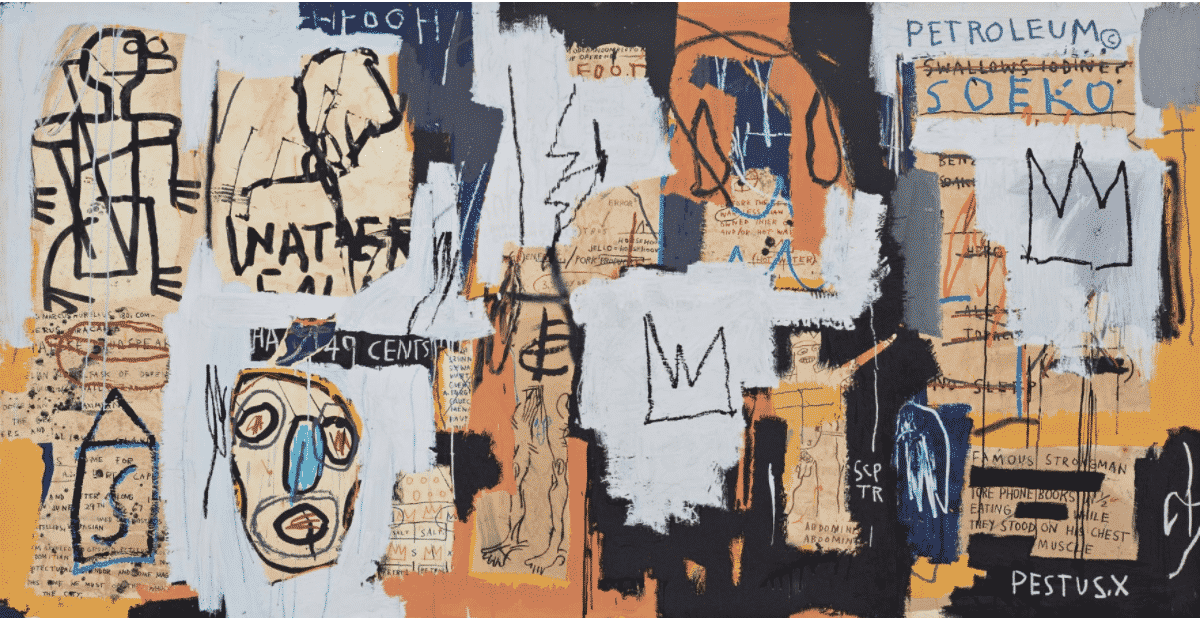

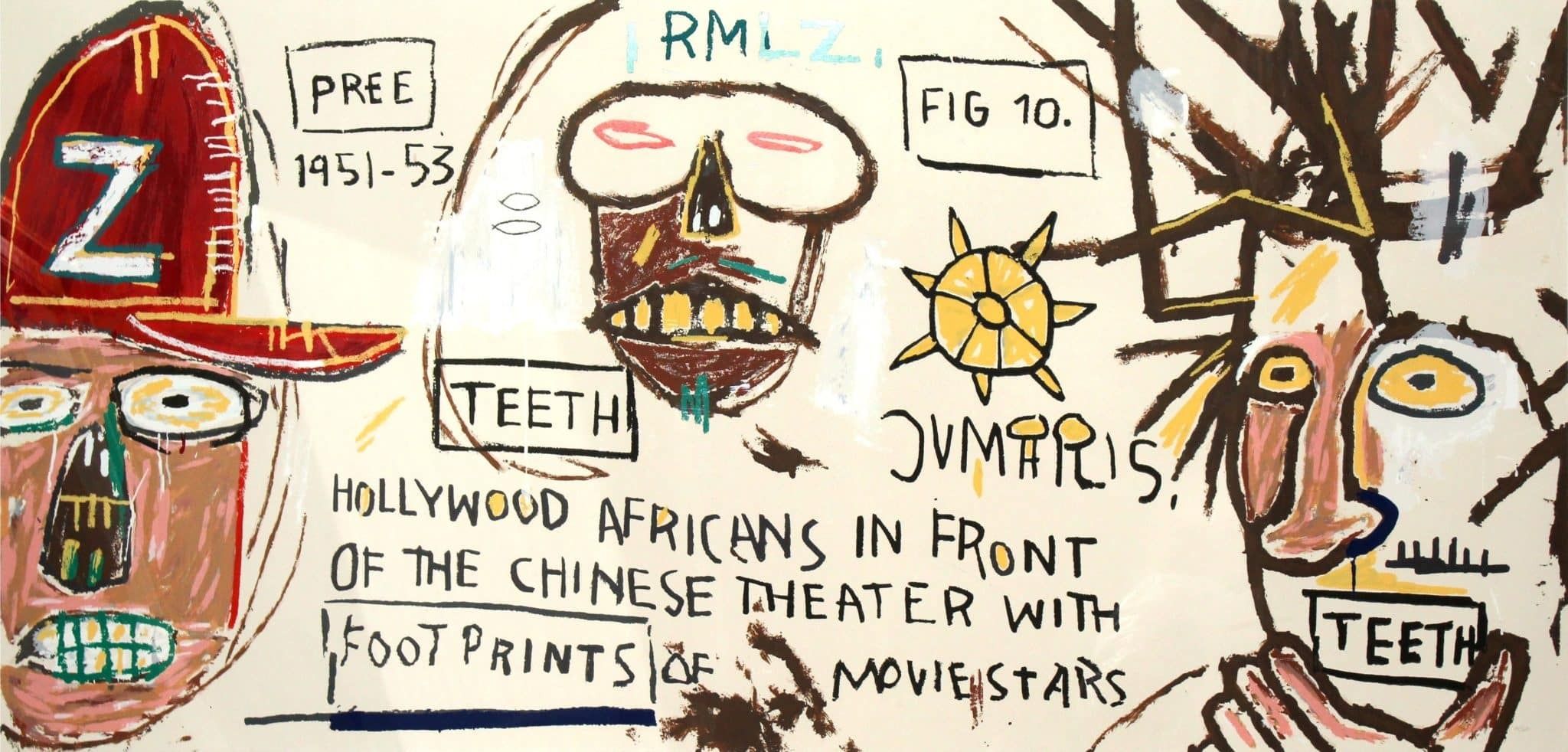

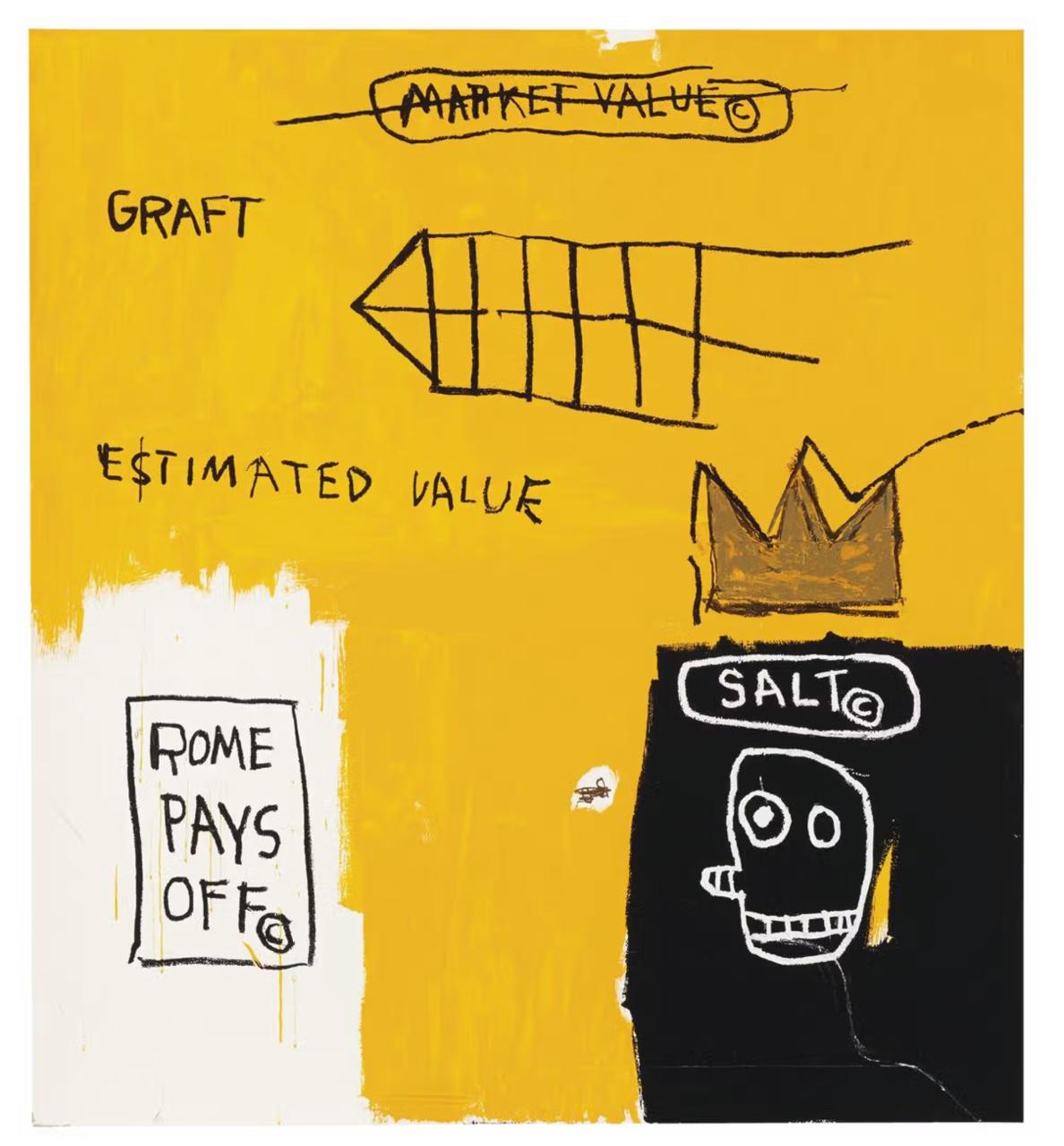

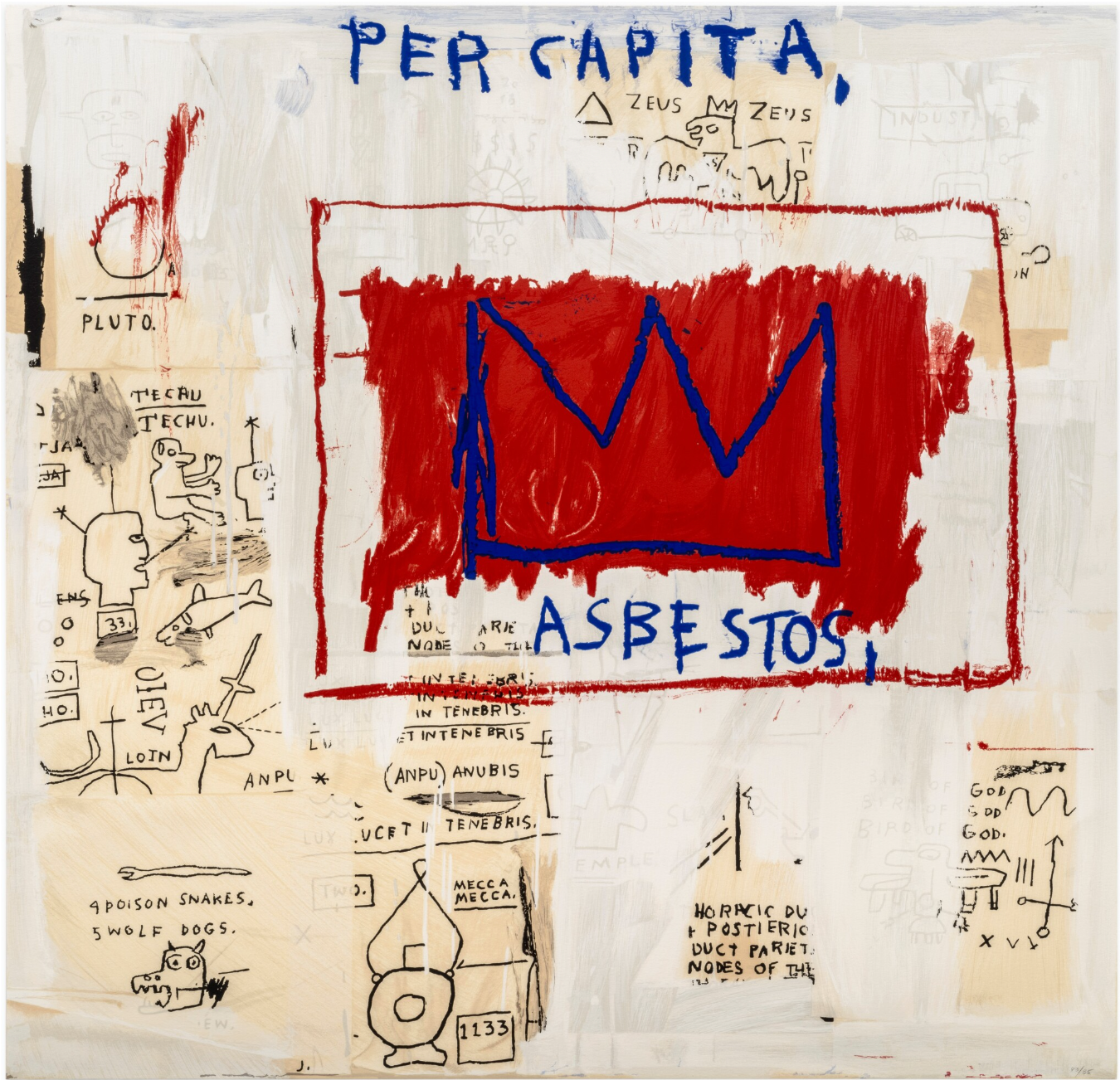

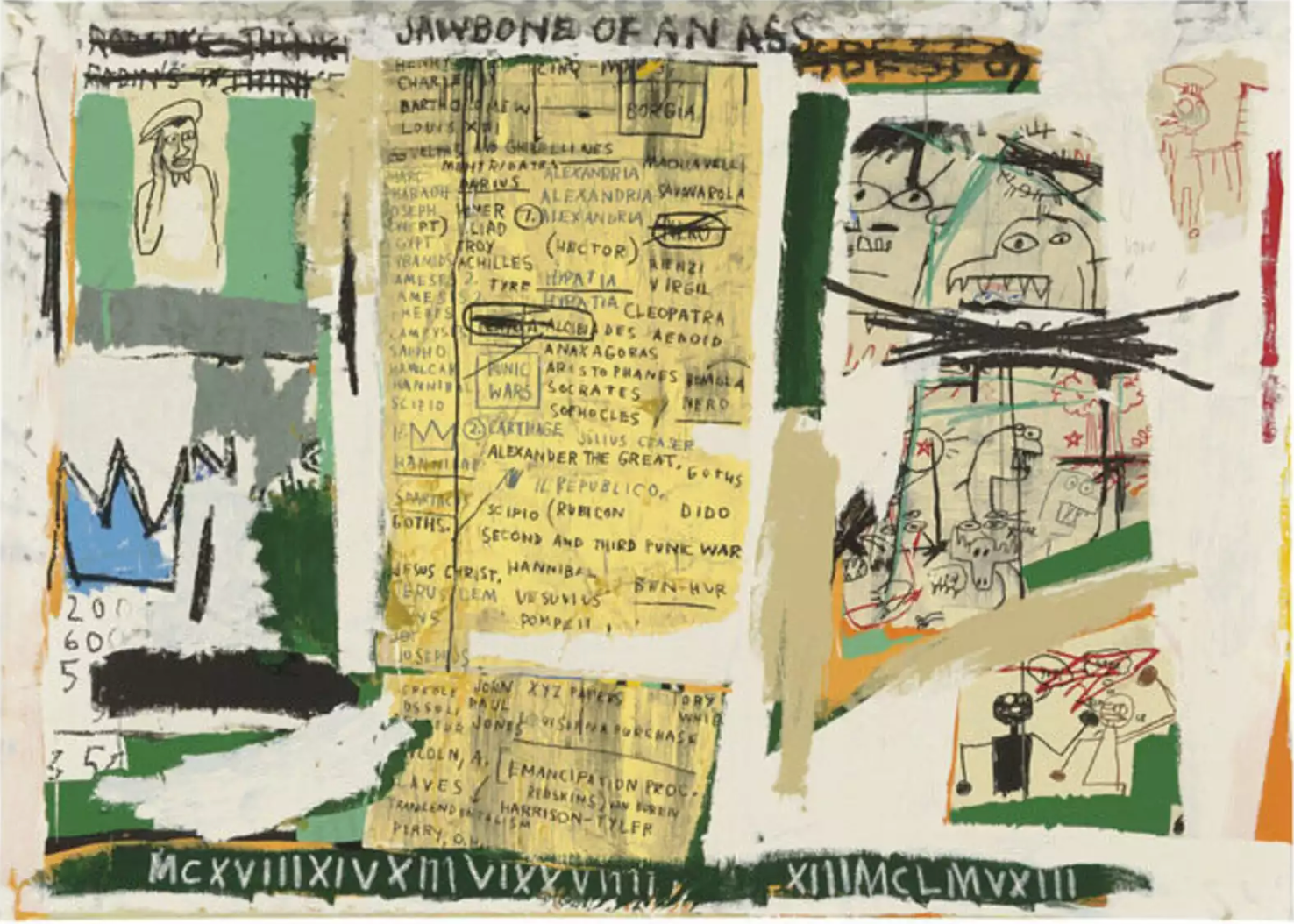

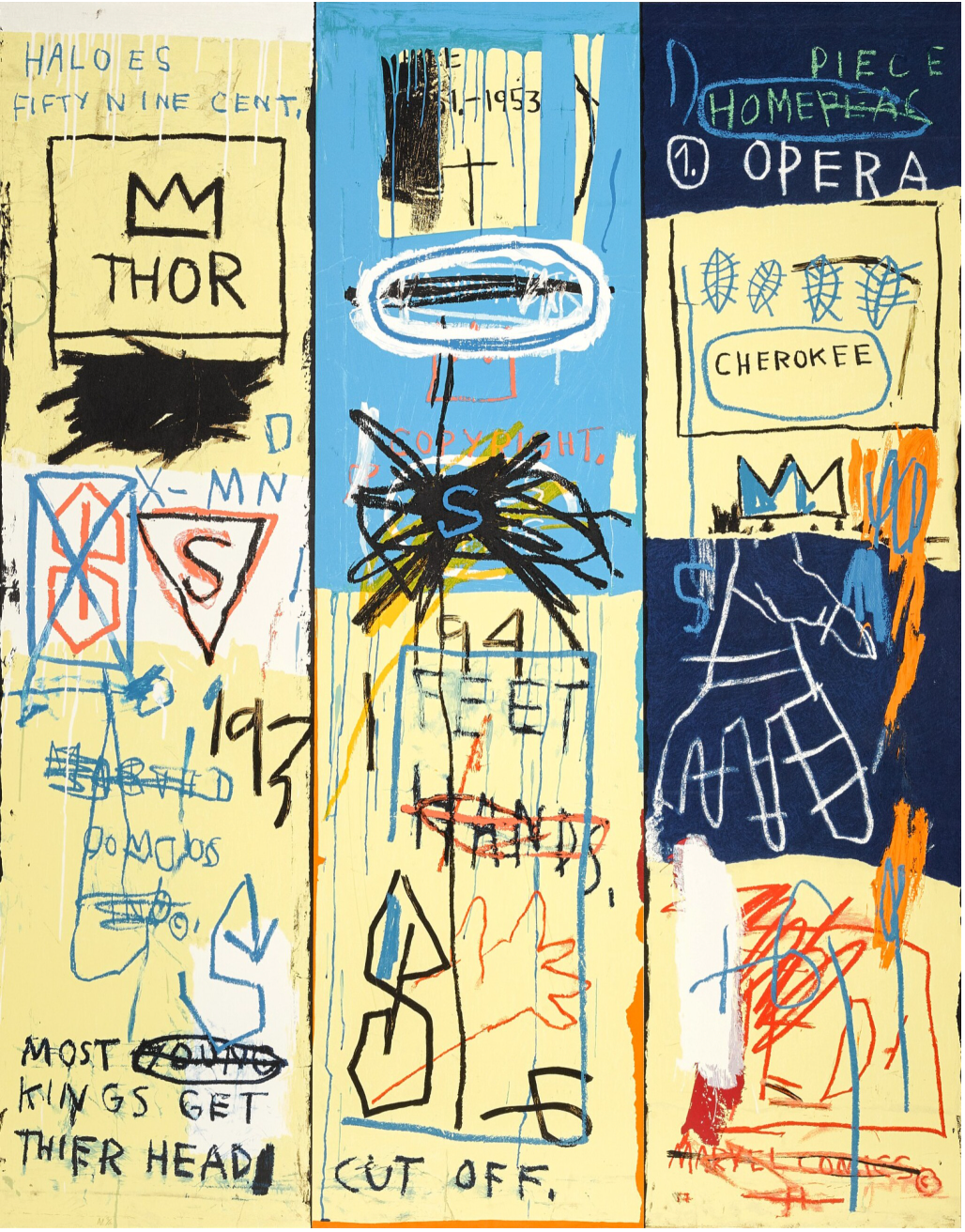

Why Jean-Michel Basquiat Is Still the Ultimate Investment Artist of Our Time

Why Jean-Michel Basquiat Is Still the Ultimate Investment Artist of Our Time

Ready to Start Your Collection?

Success in this market hinges on insight and access. ArtLife delivers both. We source investment-grade prints and blue-chip canvases that build real portfolio value. Contact ArtLife today to access our private inventory and acquire your next asset.